When insurance premiums rise, the insurance companies are always quick to blame rising repair costs as the main culprit, but a recent story in the Guardian newspaper in the UK has highlighted how it is very often the insurance claim process that is responsible for inflated claim costs and until this is streamlined premiums will keep going up.

Firstly, it has to be stated that the cost of repairs is on the rise. Increasingly sophisticated technology on vehicles, more expensive components and the need for ADAS recalibration are adding to cost. Also a lack of skilled technicians means that industry capacity is reduced. The balance of power has therefore shifted and repairers are rightly able to command higher rates for the highly complex repairs they carry out and the high level of investment they now have to make in equipment and training.

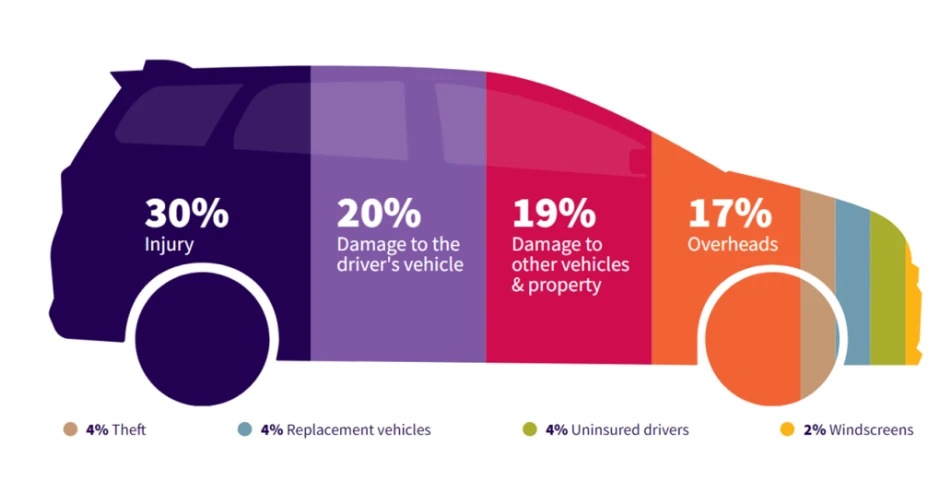

However, even with increasing repair costs, the actual percentage of an insurance premium that goes towards the direct cost of vehicle repair is estimated to be below 20%. A higher proportion, some 30%, goes on personal injury claims. The concern expressed in the Guardian article is that the way in which claims are sometimes paid is often extremely wasteful.

It provides numerous examples of drivers who thought an accident was relatively minor and where repair costs might be under £1000 actually ending up with claims costs of many thousands of pounds. Often the high cost of a replacement vehicle is to blame, especially where an accident management company acts on behalf of one of the parties. Other contributing factors and can include, claims management fees and vehicle storage costs.

One example given is of a repair that should have cost in the region of £1,500 having a final repair bill of y £15,000, which included, 11 days’ car hire at £380 a day. In another instance a claim featured a £32,000 charge for 86 days car hire.

Other examples given include cars being written off unnecessarily and one respondent who took £4,820 offered by an insurer for his written off category N car, bought the car as salvage for £626 and then had it repaired and put back on the road for £300.

It appears that in many instances claims management firms are loading extreme costs unnecessarily in the UK market and this is bound to have an effect on premium. In the Irish market at present the problem is not so acute and the experience of the UK market should act as a warning to all parties in the industry about the dangers of inflated claims costs.

You can read the full Guardian article

here.

Insurance premium cost split according insurance body ABI.

Insurance premium cost split according insurance body ABI.